- Merger with Hortonworks complete

- Q4 adjusted annualized recurring revenue up 24% year-over-year

- Operating cash flow positive for fourth quarter and fiscal year 2019

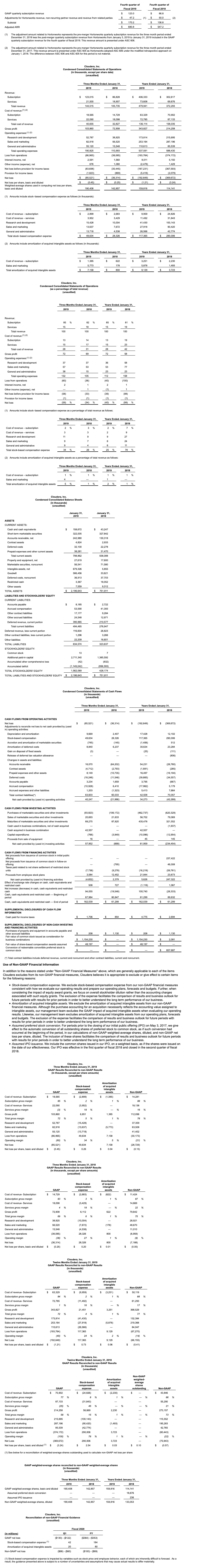

PALO ALTO, Calif., March 13, 2019 /PRNewswire/ -- Cloudera, Inc. (NYSE: CLDR), the enterprise data cloud company, reported results for its fourth quarter and fiscal year 2019, ended January 31, 2019. Total revenue was $144.5 million, an increase of 37% from the fourth quarter of fiscal 2018. Subscription revenue was $123.0 million, an increase of 42% from the fourth quarter of fiscal 2018.

"Our strong fourth quarter results showcase how customers are already embracing the new Cloudera's vision, as evidenced by early cross-sell motions to deliver data management and analytics from the Edge to AI," said Tom Reilly, chief executive officer, Cloudera. "Having completed the merger with Hortonworks, we are now squarely focused on delivering a powerful combined, integrated platform purpose-built for enterprise customers. Enterprises want an enterprise data cloud, which offers the flexibility of both hybrid and multi-cloud delivery, as well as the versatility of multi-function analytics, all with common security and governance. As the open source data management and analytics standard, we believe Cloudera is uniquely positioned to deliver these capabilities at the data layer, bring the enterprise data cloud to our more than 2,000 customers and lead this new market."

The merger with Hortonworks closed on January 3, 2019. As such, there is no comparative year-over-year financial information for the combined company. Unless otherwise stated, the information presented is on a combined company basis under ASC 6061 and ASC 340-402.

GAAP loss from operations for the fourth quarter of fiscal 2019 was $87.0 million. For reference, GAAP loss from operations for the fourth quarter of fiscal 2018 was $38.1 million for standalone Cloudera.

Non-GAAP loss from operations for the fourth quarter of fiscal 2019 was $30.2 million. For reference, non-GAAP loss from operations for the fourth quarter of fiscal 2018 was $9.0 million for standalone Cloudera.

Operating cash flow for the fourth quarter of fiscal 2019 was $40.2 million. For reference, operating cash flow for the fourth quarter of fiscal 2018 was negative $22.0 million for standalone Cloudera.

GAAP net loss per share for the fourth quarter of fiscal 2019 was $0.45 per share, based on weighted-average shares outstanding of 190.4 million shares. For reference, GAAP net loss per share for the fourth quarter of fiscal 2018 was $0.25 per share for standalone Cloudera, based on weighted-average shares outstanding of 142.9 million shares.

Non-GAAP net loss per share for the fourth quarter of fiscal 2019 was $0.15 per share, based on weighted-average shares outstanding of 190.4 million shares. For reference, non-GAAP net loss per share for the fourth quarter of fiscal 2018 was $0.05 per share for standalone Cloudera, based on weighted-average shares outstanding of 142.9 million shares.

For fiscal year 2019, total revenue was $479.9 million and subscription revenue was $406.3 million. The Hortonworks business, which closed its fiscal year on December 31, 2018, and its books as a standalone entity on January 2, 2019, contributed $15 million of subscription revenue to the combined company's results in fiscal year 2019. For reference, standalone Cloudera year-over-year subscription revenue growth for fiscal year 2019 was 29%.

GAAP loss from operations for fiscal year 2019 was $193.8 million. For reference, GAAP loss from operations for fiscal year 2018 was $374.2 million for standalone Cloudera.

Non-GAAP loss from operations for fiscal year 2019 was $67.3 million. For reference, non-GAAP loss from operations fiscal year 2018 was $80.4 million for standalone Cloudera.

Operating cash flow for fiscal year 2019 was $34.3 million. For reference, operating cash flow for fiscal year 2018 was negative $42.3 million for standalone Cloudera.

GAAP net loss per share for fiscal year 2019 was $1.21 per share, based on weighted-average shares outstanding of 159.8 million shares. For reference, GAAP net loss per share for fiscal year 2018 was $3.24 per share for standalone Cloudera, based on weighted-average shares outstanding of 114.1 million shares.

Non-GAAP net loss per share for fiscal year 2019 was $0.41 per share, based on weighted-average shares outstanding of 159.8 million shares. For reference, non-GAAP net loss per share for fiscal year 2018 was $0.57 per share for standalone Cloudera, based on non-GAAP weighted-average shares outstanding of 133.1 million shares.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the financial statement tables included in this press release. An explanation of these measures is also included below under the heading Non‑GAAP Financial Measures. See financial statement tables below for additional information regarding historical and forward-looking stock-based compensation expenses and shares outstanding.

As of January 31, 2019, the Company had total cash, cash equivalents, marketable securities and restricted cash of $540.6 million.

Recent Business and Financial Highlights

Fourth Quarter Fiscal 2019:

- Adjusted annualized recurring revenue was $680.6 million, representing 24% year-over-year growth

- Non-GAAP subscription gross margin for the quarter was 88%

- Operating cash flow was $40.2 million, including $23.0 million of merger-related payments

- Customers with annual recurring revenue greater than $100,000 were 976, up more than 85 in the period from October 3 (merger announcement) to January 31, 2019

- Completed merger with Hortonworks, creating an open-source powerhouse to build the industry's first enterprise data cloud from the Edge to AI

- Cloudera was named among Leaders in Cloud Hadoop/Spark Platforms Report by Independent Research Firm

Full Year Fiscal 2019:

- Total revenue was $479.9 million

- Subscription revenue was $406.3 million

- Non-GAAP subscription gross margin for the year was 88%

- Operating cash flow was positive for the fiscal year, a full year ahead of schedule

Business Outlook

The outlook for the first quarter of fiscal 2020, ending April 30, 2019, is:

- Total revenue in the range of $187 million to $190 million

- Subscription revenue in the range of $154 million to $156 million

- Non-GAAP net loss per share in the range of $0.25 to $0.22 per share

- Weighted-average shares outstanding of approximately 271 million shares

The outlook for fiscal 2020, ending January 31, 2020, is:

- Total revenue in the range of $835 million to $855 million, representing approximately 76% year-over-year growth

- Subscription revenue in the range of $695 million to $705 million, representing approximately 72% year-over-year growth

- Operating cash flow in the range of negative $40 million to negative $30 million

- Non-GAAP net loss per share in the range of $0.36 to $0.32 per share

- Weighted-average shares outstanding of approximately 279 million shares

- Adjusted ARR of $800 million to $825 million, representing 18% to 21% year-over-year growth

Conference Call and Webcast Information

Cloudera is hosting a conference call for analysts and investors to discuss its fourth quarter and full year fiscal 2019 results and the outlook for its first quarter of fiscal 2020 and full year fiscal 2020 at 2:00 p.m. Pacific Time today. Participants can listen via webcast by visiting the Investor Relations section of Cloudera's website. A replay of the webcast will be available for two weeks following the call.

The conference call can also be accessed as follows:

- Participant Toll Free Number: +1-833-231-7247

- Participant International Number: +1-647-689-4091

- Conference ID: 2066939

1 Accounting Standards Codification ("ASC") 606 "Revenue from Contracts with Customers"

2 ASC 340-40 "Other Assets and Deferred Costs - Contracts with Customers"

About Cloudera

At Cloudera, we believe that data can make what is impossible today, possible tomorrow. We empower people to transform complex data into clear and actionable insights. Cloudera delivers an enterprise data cloud for any data, anywhere, from the Edge to AI. Powered by the relentless innovation of the open source community, Cloudera advances digital transformation for the world's largest enterprises. Learn more at cloudera.com.

Connect with Cloudera

Learn more about Cloudera

Read our blog

Follow us on Twitter

Get updates on LinkedIn

Visit us on Facebook

See us on YouTube

Join the Cloudera Community

Read about our customers' successes

Cloudera and associated marks are trademarks or registered trademarks of Cloudera, Inc. All other company and product names may be trademarks of their respective owners.

Forward-Looking Statements

Statements in this press release that are not historical in nature are forward-looking statements that, within the meaning of the federal securities laws including the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, involve known and unknown risks and uncertainties. Words such as "may", "will", "expect", "intend", "plan", "believe", "seek", "could", "estimate", "judgment", "targeting", "should", "anticipate", "goal" and variations of these words and similar expressions, are also intended to identify forward-looking statements. The forward-looking statements in this press release address a variety of subjects, including anticipated benefits from the merger with Hortonworks and our "Business Outlook" for our first quarter of fiscal 2020 and our full year fiscal 2020 operating results. Readers are cautioned that actual results could differ materially from those implied by such forward-looking statements due to a variety of factors, including global economic conditions, competitive pressures and pricing declines, intellectual property infringement claims, and other risks or uncertainties that are described under the caption "Risk Factors" in our Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (SEC), and in our other SEC filings, including in a registration statement on Form S-4 containing a joint proxy statement/prospectus of Cloudera and Hortonworks. Although we believe the expectations reflected in such forward-looking statements are based upon reasonable assumptions, we can give no assurances that our expectations will be attained. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

We report all financial information required in accordance with U.S. generally accepted accounting principles (GAAP). To supplement our unaudited condensed consolidated financial statements presented in accordance with GAAP, we use certain non-GAAP measures of financial performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the results of our operations as determined in accordance with GAAP. The non-GAAP financial measures used by us include non-GAAP subscription gross margins, non-GAAP loss from operations, non-GAAP operating margin, non-GAAP net loss, and historical and forward-looking non-GAAP net loss per share. These non-GAAP financial measures exclude stock-based compensation, acquisition- and disposition-related expenses (if any), and amortization of acquired intangible assets from the Cloudera unaudited condensed consolidated statement of operations. In addition, we use non-GAAP weighted-average shares outstanding to calculate non-GAAP net loss per share. This non-GAAP measure includes the impact of anti-dilutive restricted stock units and stock options outstanding, on a weighted basis.

For a description of these items, including the reasons why management adjusts for them, and reconciliations of historical non-GAAP financial measures to the most directly comparable GAAP financial measures, please see the section of the accompanying tables titled "Use of Non-GAAP Financial Information" as well as the related tables that precede it. We may consider whether other significant non-recurring items that arise in the future should also be excluded in calculating the non-GAAP financial measures we use.

We believe that these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our core business, operating results or future outlook. Management uses, and believes that investors benefit from referring to, these non-GAAP financial measures in assessing our operating results, as well as when planning, forecasting and analyzing future periods. We use these non‑GAAP financial measures in conjunction with traditional GAAP measures to communicate with our board of directors concerning our financial performance. These non-GAAP financial measures also facilitate comparisons of our performance to prior periods.

Adjusted Annualized Recurring Revenue

Adjusted annualized recurring revenue ("adjusted ARR") is a non-GAAP performance metric, which we will use to assess the health and trajectory of our business. We intend to disclose contracted quarter-end ARR when all information becomes available. Until this work can be completed, we are providing annualized recurring revenue based on reported subscription revenue, or adjusted ARR. Adjusted ARR equals quarterly GAAP subscription revenue adjusted to (1) add Hortonworks' quarterly results, (2) subtract Hortonworks' post-merger results (in the case of Q4 fiscal 2019 only), (3) reverse the effects of purchase price adjustments, and (4) subtract non-recurring partner-related revenue and subscription revenue with certain related parties, multiplied by four quarters to annualize. For the fourth quarter of fiscal 2019, and the comparative period a year ago, adjusted ARR, as reconciled to GAAP results, was as follows, in millions: